Recent extreme weather events have once again put home insurance in the spotlight -particularly flooding. During a recent discussion on Newstalk with Peopl Insurance CEO, Dominic Lumsden and Alan Cantwell, the conversation turned to a worrying but increasingly common issue: homeowners only discovering after a flood that they weren’t properly insured.

Unfortunately, this is not an isolated problem. At Peopl Insurance, we regularly speak to people who believed they were fully covered, only to learn that key risks weren’t included, limits were too low, or exclusions applied that they never realised were there.

Flooding: The Risk Many People Assume Is Covered

One of the biggest misconceptions around home insurance is flooding. Many homeowners assume it’s automatically included -but that’s not always the case.

Flood cover can vary significantly between insurers. Some may exclude it entirely, others may apply higher excesses, specific conditions, or reduced limits. In areas with previous flood exposure, cover may still be available, but often through non-standard insurers who specialise in more complex risks.

The problem isn’t just availability – it’s awareness. Too often, policies are purchased on price alone, without fully understanding what is (and isn’t) included.

Underinsurance: A Hidden Risk

Flooding isn’t the only concern. Underinsurance is another major issue that tends to surface only after a claim.

This can happen when:

- The rebuild cost of a home is underestimated

- Renovations or extensions aren’t disclosed

- Property values or contents increase over time

- Policy limits haven’t been reviewed in years

When a major event occurs, the gap between what people thought they were insured for and what their policy actually covers can be devastating.

Why Broker Advice Matters – Especially for Non-Standard Risks

One key message from the Newstalk discussion was the importance of using a broker, particularly when risks aren’t straightforward.

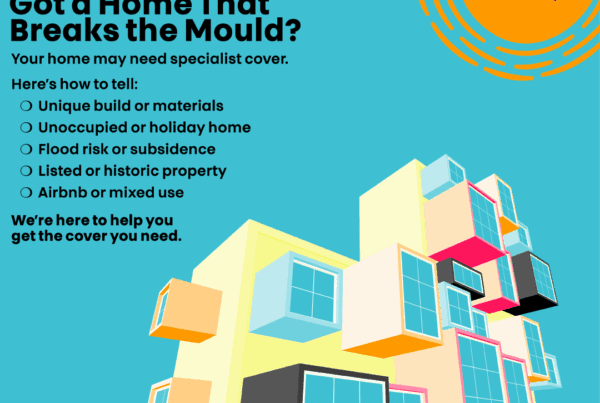

Different insurers have very different appetites. What one insurer declines outright, another may be happy to cover – provided the risk is properly understood and presented. This is especially true for:

- Flood-prone areas

- Homes with previous claims history

- Older or non-traditional properties

- Unique building materials or locations

A broker’s role is to navigate this landscape, identify the right insurer, and ensure the policy reflects the real-world risk – not assumptions.

Check Your Policy Before You Need It

If there’s one takeaway we’d encourage every homeowner to act on, it’s this:

Check your insurance policy now – not after an event.

Ask yourself:

- Is flood cover included, and on what terms?

- Are my rebuild costs accurate?

- Have I updated my policy since making changes to my home?

- Do I actually understand the exclusions and excesses?

If the answer to any of these is “I’m not sure”, that’s the moment to seek advice.

Reassurance Through Understanding

At Peopl Insurance, we believe insurance should provide peace of mind – not uncertainty. Education, clarity and proper advice are more important than ever as extreme weather events become more frequent and risks become more complex.

Understanding your cover, reviewing it regularly, and having someone in your corner who understands non-standard risks can make all the difference when it matters most.

If you’re unsure about your current cover, or simply want reassurance that it’s fit for purpose, a conversation now could prevent a very difficult situation later.