When it comes to protecting your home in Ireland, most people think of standard home insurance policies — covering risks like fire, theft, and weather damage. But what if your property doesn’t fit the mould? That’s where non-standard home insurance comes in.

We know that sounds scary. But at Peopl. We believe in making insurance fair and simple. So today we’ll explore what non-standard home insurance means, who it applies to, and how to find the right cover for your unique property.

What Is Non-Standard Home Insurance?

Non-standard home insurance is property insurance designed for homes that fall outside the scope of traditional policies. These properties may be unusual in structure, location, usage, or ownership.

Typical home insurance policies often wont cover these properties and insurers will often impose higher premiums due to perceived risks. Non-standard insurance providers specialise in tailoring policies to suit these circumstances.

What Is Non-Standard Home Insurance?

If your property falls into one of the following categories, you may need non-standard home insurance in Ireland:

Non-Standard Construction

Homes built with:

- Timber Frames

- Flat Roofs

- Thatched Roofs

- Steel Frames

- Modular Construction

These materials and methods signify higher risk to insurers, often to do with increased difficulty of repair or increased risk of damages.

Unoccupied or Vacant Homes

If your home is unoccupied for more than 30 days (common with holiday homes or properties between tenants), standard insurers may not offer cover. This is due to a perceived increase of risk for things life theft, or damages that would worsen if not remedied quickly (a plumbing leak for example).

Listed or Historic Buildings

Protected structures come with specific repair and renovation restrictions, making them costly and complex to insure. The majority of people reading this probably wont have to worry here. But for those that do, finding cover can be extremely difficult and also expensive.

Homes With Subsidence History or Flood Risk

Areas prone to flooding or properties with prior subsidence claims are often flagged as high risk by mainstream insurers. This may be due to proximity to a river, or being built on marshy ground initially. Often it isn’t your fault at all, however the increased risk does mean increased premiums.

Converted or Mixed-Use Properties

Barn conversions, homes with annexes, or residential properties with commercial use (e.g., Airbnb or home businesses) may require specialist policies. While some owners may try to skirt this with a white lie, it is a false economy. Claiming your AirBnB is a family home might give you lower premiums but it’s an easy way for your insurer to deny your claim too.

Why Standard Insurance Cover May Be Declined:

Insurers rely on historical data to assess risk. Non-standard homes often deviate from these risk profiles, making it harder to predict potential claims. Factors such as maintenance difficulty, repair costs, or increased vulnerability to environmental factors make these homes less.

attractive to standard underwriters. Ultimately an underwriter is gambling on your property. They are hoping that nothing bad ever happens to it. To do that they look at the statistics. So increased risk means they charge a higher premium to cover any potential losses.

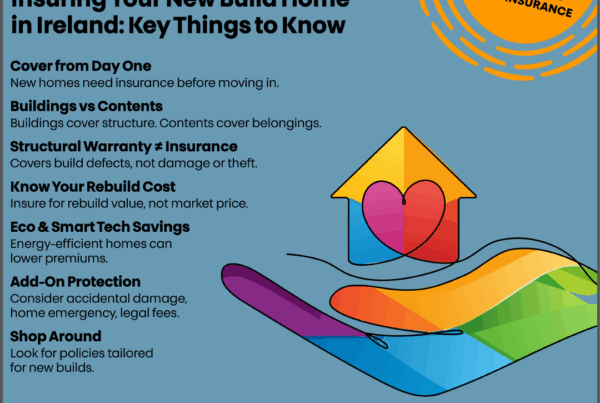

How To Get Non-Standard Home Insurance In Ireland:

Use A Specialist Broker

Seek out brokers that specifically work with non-standard policies (like us!). We work with niche insurers and can access policies not available directly to consumers. Fair insurance is what we pride ourselves on, even with a non-standard policy we work hard to get you the best value across a range of underwriters.

Be transparent

Always disclose full details about the property’s construction, history, and usage. Incomplete or inaccurate information can lead to claim denial. Sure you might trick the insurance company into giving you a lower premium, but the truth is, underwriters don’t mind being tricked if it means they get to deny a claim for it.

Get a Valuation

A professional survey or valuation can help you and your insurer understand the true rebuild cost, which is essential for adequate coverage. Even more so than with standard policies you need to understand the different values of your property. Insurance works off the rebuild value not the market value of your property.

Non-standard build will likely reflect that in the rebuild value, and that won’t always be more expensive. One of the big draws of non-standard construction is that is can work out cheaper to rebuild than traditional brick and mortar designs, so understanding your rebuild costs could be a way to bring your premiums down.

Understand Exclusions

Non-standard policies often have different terms and exclusions. Always read the fine print and ask about:

- Water Damage Cover

- Theft Limits

- Business Use Clauses

Every policy has different exclusions. Often they are based on being too much of a risk or being a foreseeable and avoidable problem for the underwriter. Electrical systems that are sixty years old pose a significant and avoidable fire risk for example.

Final Thoughts

Owning a non-standard home in Ireland shouldn’t mean settling for subpar protection. Whether you live in a converted church, a thatched cottage in the West, or a Dublin townhouse with a flat roof, there are insurance options tailored to your situation.

Partnering with a knowledgeable broker and choosing a specialist insurer can give you the peace of mind that your unique home is properly protected. So don’t hesitate to get in touch with us today so we can help you get the quote you need.